World market of goods and services is a system of economic relations in the field of exchange, which is formed between subjects (states, enterprises engaged in foreign economic activity, financial institutions, regional blocs, etc.) regarding the sale and purchase of goods and services, i.e. objects of the world market.

As an integral system, the world market took shape by the end of the 19th century, simultaneously with the completion of the formation of the world economy.

The global market for goods and services has its own characteristics. The main thing is that transactions for the purchase and sale of goods and services are made by residents of various states; goods and services, moving from producer to consumer, cross the borders of sovereign states. The latter, implementing their foreign economic (foreign trade) policy, with the help of various tools (customs duties, quantitative restrictions, requirements for the compliance of goods with certain standards, etc.) have a significant impact on commodity flows both in terms of geographical orientation and industry accessories, intensity.

The regulation of the movement of goods on the world market is carried out not only at the level of individual states, but also at the level of interstate institutions - the World Trade Organization (WTO), the European Union, the North American Free Trade Agreement, etc.

All member countries of the World Trade Organization (as of August 24, 2012, there were 157 of them, Russia became the 156th) undertake the obligation to implement 29 major agreements and legal instruments, united by the term "multilateral trade agreements", covering over 90% of all world trade in goods and services.

Fundamental principles and rules of the WTO are:

· provision of the most favored nation treatment in trade on a non-discriminatory basis;

· mutual provision of national treatment for goods and services of foreign origin;

regulation of trade mainly by tariff methods;

Refusal to use quantitative restrictions;

• transparency of trade policy;

· resolution of trade disputes through consultations and negotiations.

International trade affects the state of the national economy by performing the following tasks :

1. Filling in the missing elements of national production, which makes the "consumer basket" of economic agents of the national economy more diverse;

2. Transformation of the natural-material structure of GDP due to the ability of external factors of production to modify and diversify this structure;

3. Effect-forming function, i.e. the ability of external factors to influence the growth of the efficiency of national production, the maximization of national income while reducing the socially necessary costs of its production.

Foreign trade operations purchase and sale of goods are the most common and traditional for international trade.

Purchase and sale transactions goods are divided into the following:

export;

import;

· re-export;

re-import;

countertrade.

Export operations involve the sale and export of goods abroad for their transfer to the ownership of a foreign counterparty.

Import operations- purchase and import of foreign goods for their subsequent sale in the domestic market of their country or consumption by the importing enterprise.

Re-export and re-import operations are a kind of export-import operations.

Re-export operation- this is the export abroad of previously imported goods that have not undergone any processing in the re-exporting country. Such transactions are most often encountered when selling goods at auctions and commodity exchanges. They are also used in the implementation of large projects with the participation of foreign firms, when the purchase of certain types of materials and equipment is carried out in third countries. In this case, as a rule, goods are sent to the country of sale without importing products to the country of re-export. Quite often, re-export operations are used to make a profit due to the difference in prices for the same product in different markets. In this case, the goods are also not imported into the re-exporting country.

A significant number of re-export operations are carried out on the territory of free economic zones. Goods imported into free economic zones are not subject to customs duties and are exempt from any duties, fees and taxes on import, circulation or production when exported for re-export. Customs duty is paid only when goods are moved across the customs border into the country.

Re-import operations involve the import from abroad of previously exported domestic goods that have not been processed there. These can be goods not sold at auction, returned from a consignment warehouse, rejected by the buyer, etc.

In recent decades, qualitatively new processes in the organization and technique of international trade operations continue to be actively developed. One such process was the widespread countertrade.

At the core counter trade is the conclusion of counter transactions that link export and import operations. An indispensable condition for counter transactions is the obligation of the exporter to accept as payment for its products (for its full value or part of it) certain goods of the buyer or arrange for their purchase by a third party.

There are the following forms of countertrade: barter, counter-purchase, direct compensation.

Barter- This is a natural, without the use of financial calculations, the exchange of a certain product for another.

Terms counter purchases the seller delivers the goods to the buyer on normal commercial terms and at the same time undertakes to purchase counter goods from him in the amount of a certain percentage of the amount of the main contract. Therefore, a counter purchase provides for the conclusion of two legally independent, but actually interconnected purchase and sale transactions. In this case, the primary contract includes a clause on the obligations of the purchase and liability in case of non-fulfillment of the purchase.

Direct Compensation involves the mutual supply of goods on the basis of one contract of sale or on the basis of a contract of sale and the agreements attached to it on counter or advance purchases. These transactions have an agreed mechanism of financial settlements in the presence of commodity and financial flows in each direction. Like barter transactions, they contain the obligation of the exporter to purchase goods from the importer. However, in compensation, in contrast to barter, deliveries are paid independently of each other. At the same time, financial settlements between the parties can be carried out both by transferring foreign currency and by settling mutual clearing claims.

In practice, the main incentive for concluding most offset transactions is the desire to avoid the transfer of foreign currency. To do this, a clearing form of settlement is used, in which, after the goods are sent by the exporter, their payment requirements are entered into a clearing account in the importer's country, and then satisfied through a counter delivery.

To analyze the dynamics of international trade in goods, indicators of the cost and physical volume of foreign trade are used. The value of foreign trade is calculated for a certain period of time at current prices of the analyzed years using current exchange rates. Actual volume of foreign trade calculated in constant prices and allows you to make the necessary comparisons and determine its real dynamics.

Along with international trade in goods, there is a widely developed and trade in services. International trade in goods and trade in services are closely related. When delivering goods abroad, more and more services are being provided, starting with market analysis and ending with the transportation of goods. Many types of services entering the international circulation are included in the export and import of goods. At the same time, international trade in services has some features compared to traditional trade in goods.

The main difference is that services usually do not have a materialized form, although a number of services acquire it, for example: in the form of magnetic media for computer programs, various documentation printed on paper. However, with the development and spread of the Internet, the need to use a material shell for services is significantly reduced.

Services, unlike goods, are produced and consumed mostly simultaneously and are not subject to storage. In this regard, the presence abroad of direct service providers or foreign consumers in the country of production of services is often required.

The concept of "service" includes a complex of diverse types of human economic activity, causing the existence of various options for classifying services.

International practice defines the following 12 service sectors, which, in turn, include 155 sub-sectors:

1. commercial services;

2. postal and communication services;

3. construction works and structures;

4. trading services;

5. services in the field of education;

6. security services environment;

7. services in the field of financial intermediation;

8. health and social services;

9. services related to tourism;

10. services for organizing recreation, cultural and sports events;

11. transport services;

12. other services not included anywhere.

In the system of national accounts, services are divided into consumer (tourism, hotel services), social (education, medicine), production (engineering, consulting, financial and credit services), distribution (trade, transport, freight).

The WTO focuses on the relationship between the producer and the consumer of services, highlighting four types of transactions in international trade in services :

A. From the territory of one country to the territory of another country (cross-border supply of a service). For example, sending information data to another country via telecommunications networks.

B. Consumption of a service in the territory of another country (consumption abroad) implies the need to move the buyer (consumer) of the service to another country in order to receive (consume) the service there, for example, when a tourist goes to another country for recreation.

C. Supply through commercial presence in the territory of another country (commercial presence) means the need for the movement of factors of production to another country in order to provide services in the territory of that country. This means that a foreign service provider must invest in the country's economy, create a legal entity there in order to provide services. We are talking, for example, about the creation or participation in the creation of banks, financial or insurance companies in the territory of another country.

D. Delivery through the temporary presence of natural persons in the territory of another country means that individual moves to another country in order to provide services in its territory. An example would be the services provided by a lawyer or consultant.

In conditions of a high degree of saturation of the world market with goods and tougher competition on it, services provided to the business sector, for example, engineering, consulting, franchising, etc., become important. Tourism, healthcare, education, culture and art have great export potential.

Let us briefly describe some of the types of services.

Engineering is an engineering and consulting service for the creation of enterprises and facilities.

The whole set of engineering services can be divided into two groups: firstly, services related to the preparation of the production process and, secondly, services to ensure the normal course of the production process and product sales. The first group includes pre-project services (mineral exploration, market research, etc.), project services (drafting a master plan, project cost estimation, etc.) and post-project services (supervision and inspection of work, training of personnel, etc. .). The second group includes services for the management and organization of the production process, inspection and testing of equipment, operation of the facility, etc.

Consulting is the process of providing the client with the special knowledge, skills and experience necessary for the implementation of professional activities.

Consulting services can be considered from the point of view of the subject of consulting and classified depending on the sections of management: general management, financial management, etc. Based on the method of consulting, for example, expert and training consulting are distinguished.

The services of consultants are intended for use by the management of companies, i.e. decision makers and those related to the activities of the organization as a whole. By attracting a consultant, the client expects to receive from him assistance in the development or reorganization of the business, expert opinions on some decisions or situations, and finally, just to learn or adopt certain professional skills from him. In other words, consultants are invited to remove the uncertainty that arises at different stages of the process of preparation, adoption and implementation of responsible decisions.

Franchising– a system for the transfer or sale of technology and trademark licenses. This type of service is characterized by the fact that the franchisor transfers not only exclusive rights based on a license agreement to engage in entrepreneurial activities, but also includes assistance in training, marketing, management in exchange for financial compensation from the franchisee. Franchising as a business assumes that, on the one hand, there is a firm known in the market and having a high image, and on the other, a citizen, a small entrepreneur, a small firm.

Rent- a form of management in which, on the basis of an agreement between the lessor and the lessee, various objects necessary for independent management are transferred to the latter for temporary paid possession and use.

The subjects of lease may be land and other movable property, machinery, equipment, various durable goods.

Widespread in international commercial practice has become a long-term lease, called leasing.

For a leasing operation, the following scheme is most typical. The lessor concludes a lease contract with the lessee and signs a sales contract with the equipment manufacturer. The manufacturer transfers the leased item to the tenant. The leasing company, at its own expense or through a loan received from a bank, pays off the manufacturer and repays the loan from rental payments.

There are two forms of leasing: operational and financial. Operational leasing provides for the lease of equipment for a period that is shorter than the amortization period. In this case, the machinery and equipment are subject to a series of successive short-term lease agreements, and the full depreciation of the equipment occurs as a result of its successive use by several lessees.

Financial leasing provides for the payment during the period of its validity of amounts covering the full cost of the equipment, as well as the profit of the lessor. In this case, the leased equipment cannot be repeatedly subject to lease agreements, since the lease term is usually set on the basis of its normal effective life. Such a rental operation is in many ways reminiscent of a regular foreign trade sale and purchase transaction, but on specific conditions similar to the forms of commodity lending.

Tourist services are a widespread type of activity in modern conditions. International tourism covers the category of persons traveling abroad and not engaged in paid activities there.

Tourism can be classified according to various criteria:

ü goal: route-cognitive, sports and health-improving, resort, amateur, festival, hunting, shop-tourism, religious, etc.;

ü form of participation: individual, group, family;

ü Geography: intercontinental, international, regional, according to seasonality - active tourist season, off-season, off-season.

A separate group of transactions for the purchase and sale of services represents operations for servicing the turnover. These include operations:

ü international transportation of goods;

ü Freight forwarding;

ü Cargo insurance;

ü cargo storage;

ü according to international settlements, etc.

1. International trade in goods and services.

International trade as the main form of international economic relations. The basis of economic relations in the MX is international trade. It accounts for about 80% of the total volume of MEO. The material basis for the development of trade is the increasingly deepening international division of labor, which objectively determines the connection between individual territories and countries specializing in the production of a particular product. The interaction of producers of various countries in the process of buying and selling goods and services forms the relations of the world market.

International trade is the sphere of international commodity-money relations, a specific form of exchange of products of labor (goods and services) between sellers and buyers. different countries. If a international trade represents the trade of one country with other countries, consisting of import (import) and export (export) of goods and services, then international trade is the aggregate of foreign trade of the countries of the world.

International trade affects the state of the national economy by performing the following functions:

1) replenishment of the missing elements of national production, which makes the "consumer basket" of economic agents of the national economy more diverse;

2) transformation of the natural-material structure of GDP due to the ability of external factors of production to modify and diversify this structure;

3) effect-forming function, i.e. the ability of external factors to influence the growth of the efficiency of national production, the maximization of national income while reducing the socially necessary costs of its production.

International trade arose in antiquity, it was conducted in the slave and feudal society. At that time, a small part of the manufactured products entered the international exchange, mainly luxury goods, spices, and some types of raw materials. Since the second half of the 20th century, international trade has intensified significantly. Analyzing the processes taking place in modern international trade, one can single out its main trend - liberalization: there is a significant decrease in the level of customs duties, many restrictions and quotas are cancelled. At the same time, the policy of protectionism aimed at protecting the national producer is being strengthened. According to forecasts, high rates of international trade will continue into the first half of the 21st century.

In international trade, two main methods (methods) of trade are used: direct method - transaction directly between the producer and the consumer; indirect method - transaction through an intermediary. The direct method brings certain financial benefits: it reduces costs by the amount of the commission to the intermediary; reduces the risk and dependence of the results of commercial activities on the possible dishonesty or insufficient competence of the intermediary organization; allows you to constantly be in the market, take into account changes and respond to them. But the direct method requires considerable commercial skill and trading experience.

International trade in goods takes place in a wide variety of forms. Forms of international trade are types of foreign trade operations. These include: wholesale trade; counter trade; commodity exchanges; futures exchanges; international trades; international auctions; trade fairs.

Currently, almost all subjects of the world economy are involved in international trade. The share of developed countries accounts for 65% of export-import transactions, the share of developing countries - 28%, the share of countries with economies in transition - less than 10%. The undoubted leaders in world trade are the USA, Japan and the EU countries. In recent years, there has been a steady downward trend in the share of developed countries in world trade (back in the 1980s they accounted for 84% of world exports and imports) due to the rapid development of a number of developing countries.

Question 2. International trade in goods. International trade is also characterized by such categories as "export" and "import". Export (export) of goods means the sale of goods on the foreign market. Import (import) of goods is the purchase of foreign goods. Main forms of export (import):

– export (import) of finished products with pre-sale refinement in the country of the buyer;

– export (import) of finished products;

– export (import) of disassembled products;

– export (import) of spare parts;

– export (import) of raw materials and semi-finished products;

– export (import) of services;

– temporary export (import) of goods (exhibitions, auctions).

International trade is characterized by three important characteristics: total volume (foreign trade turnover); commodity structure; geographical structure.

Foreign trade turnover - the sum of the value of exports and imports of a country. The goods are included in the international exchange when crossing the border. The sum of exports and imports forms the turnover, and the difference between exports and imports is the trade balance. The trade balance can be positive (active) or negative (deficit, passive). A trade surplus is the excess of a country's merchandise exports over its merchandise imports. Passive trade balance - foreign trade balance, which is characterized by an excess of imports of goods (imports) over exports (exports). The composition of world trade includes all commodity flows circulating between countries, regardless of whether they are sold on market or other terms, or remain the property of the supplier. In the international practice of statistical accounting of exports and imports, the date of registration is the moment when goods pass through the customs border of the country. The cost of exports and imports is calculated in most countries at contract prices reduced to a single basis, namely: export - at FOB prices, import - at CIF prices.

Considering the commodity structure of international trade in the first half of the 20th century (until World War II) and in subsequent years, significant changes can be noted. If in the first half of the century 2/3 of the world trade was accounted for by food, raw materials and fuel, then by the end of the century they accounted for 1/4 of the trade. The share of trade in manufacturing products increased from 1/3 to 3/4. More than 1/3 of all world trade is trade in machinery and equipment. A rapidly developing area of international trade is the trade in chemical products. It should be noted that there is a trend towards an increase in the consumption of raw materials and energy resources. However, the growth rate of trade in raw materials lags markedly behind the overall growth rate of world trade. In the global food market, such trends can be explained by the decline in the share of the agricultural sector itself compared to industry. Also, this slowdown is explained by the desire for self-sufficiency in food in developed and a number of developing countries (especially in China and India). Active trade in machinery and equipment has given rise to a number of new services, such as engineering, leasing, consulting, information and computing services, which, in turn, stimulates cross-country exchange of services, especially scientific, technical, industrial, communicative financial and credit nature. At the same time, trade in services (especially such as information and computing, consulting, leasing, engineering) stimulates world trade in industrial goods. Trade in science-intensive goods and high-tech products is developing most dynamically, which stimulates the cross-country exchange of services, especially of a scientific, technical, industrial, communication, financial and credit nature. In addition to traditional types of services (transport, financial and credit, tourism, etc.), new types of services, developing under the influence of scientific and technological revolution, occupy an increasing place in international exchange. The commodity structure of international trade is presented in table 2.

Thus, the world market for goods on present stage is significantly diversified, and the product range of foreign trade turnover is extremely wide, which is associated with the deepening of MRT and a huge variety of needs for industrial and consumer goods.

There have been significant changes in the geographical structure of international trade under the influence of economic and political factors in the world since the 90s of the twentieth century. The leading role still belongs to the industrialized countries. In the group of developing countries, there is a pronounced unevenness in the degree of participation in international trade in goods.

Table 2.10.1 - Commodity structure of world exports by main groups of goods,%

|

Main product groups |

First half twentieth century |

End XXcentury |

|

Food (including drinks and tobacco) |

||

|

mineral fuel |

||

|

Manufacturing products, including: |

||

|

equipment, vehicles |

||

|

chemical goods |

||

|

other manufacturing products industry |

||

|

Ferrous and non-ferrous metals |

||

|

Textiles (fabrics, clothing) |

The share of the countries of the Middle East is decreasing, which is explained by the instability of oil prices and the aggravation of contradictions between the OPEC states. Unstable foreign trade position of many African countries included in the group of the least developed. South Africa provides 1/3 of African exports. The position of the countries of Latin America is also not stable enough, because their raw material export orientation remains (2/3 of their export earnings come from raw materials). The increase in the share of Asian countries in international trade was ensured by high economic growth rates (on average 6% per year) and the reorientation of its exports to finished products (2/3 of the value of exports). Thus, the increase in the total share of developing countries in international trade is provided by new industrial countries (China, Taiwan, Singapore). Gaining weight Malaysia, Indonesia. The main flow of international trade falls on developed countries - 55%; 27% of international trade is between developed countries and developing countries; 13% between developing countries; 5% - between countries with economies in transition and all other countries. The economic power of Japan has significantly changed the geography of international trade, giving it a tripolar character: North America, Western Europe and the Asia-Pacific region.

International trade in services.

At present, along with the goods market, the services market is also rapidly developing in the MX, because The service sector occupies a significant place in national economies ah, especially in developed countries. The service sector developed especially rapidly in the second half of the 20th century, which was facilitated by the following factors:

- the deepening of the international division of labor leads to the formation of new types of activity, and, above all, in the service sector;

- a long economic recovery in most countries, which has led to an increase in growth rates, business activity, the solvency of the population, the demand for services is growing;

- the development of scientific and technical progress, which leads to the emergence of new types of services and the expansion of their scope;

– development of other forms of IER

Specificity of services: services are produced and consumed at the same time, they are not stored; services are intangible and invisible; services are characterized by heterogeneity, variability of quality; not all types of services can be involved in international trade, for example, utilities; there are no intermediaries in trade in services; international trade in services is not subject to customs control; international trade in services, more than trade in goods, is protected by the state from foreign competitors.

International practice defines the following 12 service sectors, which, in turn, include 155 sub-sectors: commercial services; postal and communication services; construction works and structures; trading services; educational services; environmental protection services; services in the field of financial intermediation; health and social services; services related to tourism; services for organizing recreation, cultural and sports events; transport services; other, not included services. In the system of national accounts, services are divided into consumer (tourism, hotel services), social (education, medicine), production (engineering, consulting, financial and credit services), distribution (trade, transport, freight).

The international exchange of services is mainly carried out between developed countries and is characterized by a high degree of concentration. Developed countries are the main exporters of services. They account for about 70% of world trade in services, and there has been a steady trend towards a reduction in their role due to the rapid development of a number of developing countries. The volume of international trade in services exceeds 1.6 trillion. $, growth rates are also dynamic. In terms of growth rates and volume in the world economy, the following types of services are leading: financial, computer, accounting, auditing, advisory, legal. A country's specialization in certain types of services depends on the level of its economic development. AT developed countries dominated by financial, telecommunications, information and business services. For developing countries characterized by specialization in transport and tourism services.

International regulation of trade.

The development of international economic relations is accompanied not only by the national regulation of foreign trade, but also by the emergence in recent decades of various forms of interstate interaction in this area. As a result, the regulatory measures of one country have a direct impact on the economies of other states, which take retaliatory steps to protect their producers and consumers, which makes it necessary to coordinate the regulatory process at the interstate level. International trade policy -a coordinated policy of states in order to conduct trade between them, as well as its development and positive impact on the growth of individual countries and the world community.

The main subject of international trade liberalization remains the international trade organization GATT/WTO. GATT - an international agreement for consultations on international trade issues(This is a code of conduct for international trade). GATT was signed in 1947 by 23 countries and operated until 1995, when the World Trade Organization (WTO) was established on its basis. GATT promoted trade liberalization through international negotiations. The functions of the GATT were to develop rules for international trade, to regulate and liberalize trade relations.

Main GATT principles: trade must be non-discriminatory; elimination of discrimination through the introduction of the most favored nation principle in relation to the export, import and transit of goods; liberalization of international trade by reducing customs duties and eliminating other restrictions; trade security; the predictability of the actions of entrepreneurs and the regulation of the actions of governments; reciprocity in granting trade and political concessions, settling disputes through negotiations and consultations; the use of quantitative restrictions is not allowed, all measures of quantitative restriction must be transformed into tariff duties; tariffs must be reduced through amicable negotiations and cannot be subsequently increased; when making decisions, participating countries must conduct mandatory consultations among themselves, ensuring the inadmissibility of unilateral actions.

The WTO monitors the implementation of all previous agreements concluded under the auspices of the GATT. Membership in the WTO means for each member state the automatic acceptance in full of its package of already concluded agreements. In turn, the WTO significantly expands the scope of its competence, turning into the most important international body that regulates the development of international economic relations. Countries wishing to join the WTO must: begin the process of rapprochement with WTO member countries, which takes a significant amount of time; make trade concessions; comply with GATT/WTO principles.

Belarus is not yet a member of the WTO and is in a discriminatory position in the world market. It bears losses from anti-dumping policy; it is subject to restrictions on the supply of high technologies. In addition, Belarus is not yet ready to join the WTO, but constant work is being done in this direction.

United Nations Conference on Trade and Development (UNCTAD) has been convened since 1964 once every 4 years. The most significant UNCTAD decisions are the Generalized System of Preferences (1968), the New International Economic Order (1974) and the Integrated Raw Materials Program (1976). The general system of preferences means the provision of trade preferences to developing countries on a non-reciprocal basis. This means that developed countries should not demand any concessions in return for their goods in the markets of developing countries. Since 1971, developed countries began to provide a general system of preferences to developing countries. The USSR lifted all restrictions on the import of goods from developing countries in 1965. In 1974. at the suggestion of developing countries, fundamental documents were adopted on the establishment new international economic order (NIEO) in relations between the countries of the North and the South. The NMEP talked about the formation of a new MRT, focused on the accelerated industrialization of developing countries; on the formation of a new structure of international trade that meets the objectives of accelerated development and raising the living standards of peoples. Developed countries were asked to make adjustments to the economic structure of their economies, to free up niches for goods from developing countries. In accordance with the NMEI, it is necessary to assist developing countries in the development of food and to promote the expansion of its exports from developing countries.

Other international organizations are also involved in international trade issues. As part of Organization for Economic Cooperation and Development (OECD), which includes all developed countries, has a Trade Committee. Its task is to promote the expansion of the world exchange of goods and services on a multilateral basis; consideration of general problems of trade policy, balance of payments, conclusions on the advisability of granting loans to members of the organization. Within the framework of the OECD, measures are being developed for the administrative and technical unification of rules in the field of foreign trade, common standards, recommendations for changing trade policy, and others are being developed. A significant impact on the foreign trade of developing countries and countries with economies in transition, especially insolvent debtors, has International Monetary Fund (IMF). Under pressure from the IMF, there is an accelerated liberalization of the markets of these countries in exchange for loans.

Send your good work in the knowledge base is simple. Use the form below

Students, graduate students, young scientists who use the knowledge base in their studies and work will be very grateful to you.

Hosted at http://www.allbest.ru/

International trade in goods and services

1. The role of international trade in the world economy

trade international pricing multiplier

All countries enter into foreign trade relations. Each side ends up consuming more than it could produce alone. This is the essence of international trade.

International trade is the sphere of international commodity-money relations, which is a set of foreign trade of all countries of the world.

International trade consists of two counter flows of goods - exports and imports - and is characterized by a trade balance and trade turnover.

Export - the sale of goods, providing for its export abroad.

Import - the purchase of goods, providing for its import from abroad.

The trade balance is the difference between the value of exports and imports ("net exports").

Trade turnover - the sum of the cost volumes of exports and imports.

Why do countries trade with each other? Although most theories are built on a national scale, trade decisions are usually made by individual companies, firms. Only when companies see that opportunities on international market may turn out to be larger than in the domestic sector, they will direct their resources to the foreign sector.

World trade has some important features:

1. Differences in mobility. International trade acts as a substitute for international resource mobility - if human and material resources cannot move freely between countries, then the movement of goods and services effectively fills this gap.

2. Currency. Each country has its own currency, and this must be taken into account when conducting export-import operations.

3. Politics. International trade is subject to strong political interference and control.

Export Incentives:

1. Use of excess capacity.

2. Reducing the unit cost of production.

3. Increasing profitability through an increase in margins (the ability, under certain conditions, to sell your products with greater profit abroad than at home).

4. Distribution of sales risk.

Import incentives:

1. Cheaper supplies of goods or raw materials.

2. Expansion of the range.

3. Reducing the risk of interruption in the supply of goods.

You can also highlight some of the obstacles to foreign trade:

Lack of knowledge about available options,

Lack of information about the mechanics of trading;

Fear of risk;

Trading restrictions.

2. Classical theories of international trade

1. Mercantilist theory

Mercantilism is a direction of economic thought developed by European scientists at the beginning of the 17th century, who emphasized the commodity nature of production (T. Man, V. Petty, and others).

The mercantilists were the first to propose a coherent theory of international trade. They believed that the wealth of countries depends directly on the amount of gold and silver that they have, and believed that the state must necessarily export goods more than it imports; regulate foreign trade to increase exports and decrease imports; prohibit or severely restrict the export of raw materials and allow duty-free imports of raw materials that are not available in the country; prohibit all trade of the colonies with countries other than the mother country.

The limitation of the mercantilists is that they failed to understand that the development of countries is possible not only through the redistribution of existing wealth, but also through its growth.

2. The theory of absolute advantages

The main economist who challenged mercantilism was A. Smith (late 18th century). Smith clearly articulated that

the state of a nation depends not so much on the amount of gold they accumulate, but on their ability to produce final goods and services. Therefore, the main task is not to acquire gold, but to develop production through the division of labor and cooperation.

The theory of absolute advantage states that international trade is profitable if two countries trade goods that each country produces at a lower cost than the partner country. Countries export those goods that they produce at lower cost (in the production of which they have an absolute advantage), and import those goods that other countries produce at lower cost (in the production of which their trading partners have an advantage).

Consider the following example. Let us assume that manufacturers in Germany and Mexico produce only two goods - equipment and raw materials. Labor costs for the production of a unit of goods (in working days) are presented in table 5.

Table 1 Initial data for the analysis of the theory of absolute advantages

|

Labor costs (working day) |

|||

|

Germany |

|||

|

Equipment |

|||

Germany has an absolute advantage in the production of equipment, since 1 worker. day< 4 раб. дней. Мексиканские производители имеют абсолютное преимущество в производстве сырья, т. к. 2 раб. дня < 3 раб. дней.

Axiom: if country A needs fewer hours to produce product X than country B, then country A has an absolute advantage over country B in the production of this product and it is profitable for it to export this product to country B. It followed from A. Smith's theory that the factors of production have absolute mobility within the country and move to those regions where they receive the greatest absolute advantage.

3. Theory of comparative advantage

D. Ricardo in 1817 proved that international specialization is beneficial for the nation. This was the well-known theory of comparative advantage, or, as it is sometimes called,

theory of comparative production costs. Let's take a closer look at this theory.

Let's say that the world economy consists of two countries - the USA and Brazil. And each of them can produce both wheat (P) and coffee (C), but with different degrees of economic efficiency.

Let us single out the characteristic features of these production possibilities curves.

1. Countries' costs of producing P and C are constant.

The production possibility lines of the two countries do not coincide - this is due to differences in the structure of resources and levels of technology. That is, the costs of P and K of the two countries are different. On fig. 1a shows that the ratio of costs for P and K for the US is 1P for 1K - or 1P=1K. From fig. 1b it follows that for Brazil this ratio is equal to 1P for 2K - or 1P=2K.

2. If the economies of both countries are closed and independently satisfy their needs for these goods, then the self-sufficiency condition for the USA is 18P and 12K (point A), and for Brazil - 8P and 4K (point B).

We have identified differences in cost ratios. Now the question arises: is there a rule by which to determine which products the US and Brazil should specialize in? There is such a rule - this is the principle of comparative advantage: the total volume of output will be greatest when each product is produced by the country in which the opportunity costs are lower. Comparing the domestic costs of these countries for the production of P and C, it can be determined that the United States has a comparative (cost) advantage in the production of P and should specialize in it. Brazil, on the other hand, has a comparative advantage in the production of K and should therefore specialize in it.

Rational economic management - the use of a certain amount of scarce resources to obtain the greatest aggregate output - requires that any product be produced by the country that has the lowest opportunity costs, or, in other words, that has a comparative advantage. In our example, the United States should produce P for the world economy, while Brazil should produce K.

An analysis of this table shows that the specialization of production in accordance with the principle of comparative advantage actually allows the whole world to get more output for a given amount of resources. By specializing entirely in wheat, the US can grow 30 P and not grow C. Similarly, by specializing entirely in coffee, Brazil can produce 20 C and not grow P.

Table 2 International specialization according to the principle of comparative advantage and gains from trade (provisional data)

However, consumers in both countries will want both wheat and coffee. Specialization generates the need to trade or exchange these two goods. What will be the terms of trade?

Logical reasoning will lead us to the following conclusion: the coefficient of international exchange, or the terms of trade, will be within this inequality:

1 TO< 1П < 2К.

The actual exchange rate depends on the global demand for and supply of the two commodities.

Having accepted the international exchange coefficient, or terms of trade, 1P = 1.5K, we will introduce into the analysis, in addition to the line of production possibilities, the line of trade possibilities - fig. 2.

The trade opportunity line shows the choices a country has when specializing in one product and exchanging (exporting) it for another product. Specialization based on the use of the principle of comparative advantage contributes to a more efficient allocation of world resources and an increase in the production of both P and C, and therefore is beneficial to both the United States and Brazil. As a result of specialization and trade, both countries have large quantity each type of product (see Table 6). The entire world economy also benefits in this case: it will receive 30 P (compared to 18 + 8 = 26 P) and 20 K (compared to 12 + 4 = 16 K), which is more than in conditions of self-sufficiency or non-specialized production countries.

The fact that points A1 and B1 in Fig. 2 reflect a more perfect situation compared to points A and B is very important.

Recall that any country can go beyond the limits of its production possibilities only by either increasing the quantity and improving the quality of its resources, or by using the results of technological progress. Now a third way has been found - international trade - by which the country is able to overcome the narrow scale of production limited by the production possibilities curve.

However, it should be noted that a country cannot endlessly develop specialization in any commodity or product. Increasing the scale of production, the country is bound to face rising costs. The most important effect of rising costs is that they put limits on specialization.

4. Theory of the ratio of factors of production

The theory of international trade was also explained through the theory of factors of production. Its authors are E. Heckscher and B. Olin, Swedish economists (mid-1920s). The essence of the theory lies in the Heckscher-Ohlin theorem: each country exports those goods for the production of which it has relatively excess production factors, and imports those goods for the production of which it experiences a relative lack of production factors.

In accordance with the Heckscher-Ohlin theory, the difference in the relative prices of goods in different countries, and hence the trade between them, is explained by the different relative endowments of countries with factors of production.

5. Testing the theory of the ratio of factors of production: Leontief's paradox

After World War II, V. Leontiev tried to empirically prove or disprove the Heckscher-Ohlin theory. Using the input-output inter-industry balance model built on the basis of data on the US economy for 1947, V. Leontiev showed that relatively more labor-intensive goods prevailed in American exports, while capital-intensive goods dominated in imports. Considering that in the early post-war years in the United States, unlike most of its trading partners, capital was a relatively abundant factor of production, and wage levels were much higher, this empirically obtained result clearly contradicted what the Heckscher-Ohlin theory suggested. This phenomenon is called the Leontief paradox. Subsequent studies confirmed the presence of this paradox in the post-war period not only for the United States, but also for other countries (Japan, India, etc.).

Leontief's paradox - the Heckscher-Ohlin theory of the ratio of factors of production is not confirmed in practice: labor-saturated countries export capital-intensive products, while capital-saturated countries export labor-intensive ones.

The answer to the “Leontief paradox” lies in:

in the heterogeneity of factors of production, primarily the labor force, which can vary significantly in terms of skill level. Therefore, the exports of industrialized countries may reflect a relative excess of highly skilled labor and specialists, while developing countries export products that require significant inputs of unskilled labor;

significant role of natural resources - raw materials, the extraction of which requires large capital expenditures (for example, in the extractive industries). Therefore, exports from many resource-rich developing countries are capital-intensive, although capital in these countries is not a relatively abundant factor of production;

Americans' traditional preference for buying foreign-made, capital-intensive technology products despite the fact that the country itself is well-endowed with capital;

reversal of factors of production, when the same product can be labor-intensive in a labor-abundant country and capital-intensive in a capital-abundant country. For example, rice produced in the United States with advanced technology is a capital-intensive commodity, while the same rice produced in labor-abundant Vietnam is a labor-intensive commodity because it is produced almost exclusively by manual labor;

influence on the international specialization of the state's foreign trade policy, which can limit imports and stimulate domestic production and exports of products from those industries that intensively use relatively scarce production factors.

3. Alternative theories international trade

The consequences of participation in foreign trade for the national economy have been specified by economists based on the use of the concept of tradable and non-tradable goods and services.

In accordance with this concept, all goods and services are divided into tradable, that is, participating in international exchange (exported and imported), and non-tradable, that is, consumed only where they are produced, and are not objects of international trade. The level of prices for non-tradable goods is formed in the domestic market and does not depend on prices in the world market. In practice, most goods and services produced in agriculture, mining and manufacturing industries are tradable. On the contrary, most of the goods and services produced in the field of construction, transport and communications, utilities, public and personal services are classified as non-tradable.

The division of goods and services into tradable and non-tradable is conditional. This division of goods and services affects the structural shifts in the economy that take place in the country under the influence of the country's participation in world trade. This is due to the fact that the demand for non-tradable goods and services can only be satisfied through domestic production, while the demand for tradable goods and services can also be met through imports.

1. Rybchinsky's theorem

The English economist T. Rybchinsky clarified the conclusions of the Heckscher-Ohlin theory of the ratio of factors of production. He proved a theorem according to which, at constant world prices and the presence of only two sectors in the economy, an increase in the use of an excess factor in one of them leads to a reduction in production and output of goods in the other. Consider Rybchinsky's theorem using a specific example (Fig. 3).

Suppose a country produces two goods: X and Y using two factors of production - capital and labor. At the same time, product X is relatively more labor-intensive, and product Y is relatively more capital-intensive. The OF vector shows the optimal combination of labor and capital based on the use of the most efficient technology in the production of goods X, and the OE vector, respectively, in the production of goods Y. The provision of the country as a whole with labor resources and capital is shown by point G, which means that the country has OJ of labor and JG Capital. In the absence of foreign trade, good X is produced in volume F, and good Y in volume E.

If a country is included in the international exchange of goods, then the production of goods Y in the export sector increases and the excess factor - capital - is used to a greater extent. This results in an increase in capital employed by GG1. With the dimensions of the other factor used - labor - being unchanged, the ratio of the production of goods X and Y is shown by the parameters of the new parallelogram.

The production of exported capital-intensive goods Y will move to point E1, that is, it will increase by EE1. On the contrary, the production of more labor-intensive goods X will move to point F1, that is, it will decrease by FF1. Moreover, the movement of capital to the export-oriented sector leads to a disproportionately large increase in the production of good Y.

2. "Dutch disease"

The concept of tradable and non-tradable goods and the Rybchinsky theorem make it possible to explain the problems that many countries faced in the last decades of the 20th century when they began intensive development of new raw export resources: oil, gas, etc., the so-called Dutch disease. This phenomenon owes its name to the fact that in the late 1960s and early 1970s, the development of natural gas in the North Sea began in Holland with the expansion of its export in the future. Economic resources began to move into gas production.

As a result, the income of the population increased, and this led to an increase in the demand for non-tradable goods and an increase in their production. At the same time, there was a curtailment of production in traditional export manufacturing industries and an increase in imports of missing goods.

The subsequent decline in commodity prices triggered a new phase of Dutch disease. There was a decrease in incomes of the population, a reduction in the production of non-tradable goods, an outflow of resources from the sectors of raw material exports. The positions of traditional export industries of the manufacturing industry have been strengthened again. Structural shifts caused by the "Dutch disease" give rise to serious social problems. "Dutch disease" different years struck Norway, Great Britain, Mexico and other countries. The experience of these countries should also be taken into account in Russia.

3. Michael Porter's Theory of Country Competitive Advantage

The theory of comparative advantage was further developed in the works of the American economist M. Porter. Based on the analysis of extensive statistical material, M. Porter created an original theory of the country's competitive advantage. The basis of this theory is the so-called "national rhombus", which reveals the main determinants of the economy that form the competitive macro-environment in which the firms of this country operate.

The "national rhombus" reveals a system of determinants that, interacting, create a favorable or unfavorable environment for realizing the country's potential competitive advantages.

These determinants are:

The parameters of the factors represent the material and non-material conditions necessary for the formation of a competitive advantage for the country as a whole and its leading export-oriented industries.

The strategy of firms, their structure and rivalry play a significant role in ensuring national competitive advantage. If the firm's strategy is not focused on activities in a competitive environment, then in the external market such firms usually do not have a competitive advantage.

The parameters of demand are, first of all, the capacity of demand, the dynamics of its development, the differentiation of types of products, the demand of buyers for the quality of goods and services. It is in the domestic market that new products must be tested before entering the world market.

Related and supporting industries provide firms in export-oriented industries with the necessary materials, semi-finished products, components, information, act necessary condition creating and maintaining a competitive advantage in global trade for firms in relevant industries.

In the overall picture of competitive advantages, M. Porter also assigns a role to chance and government.

4. Development of modern international trade

International trade is one of the leading forms of international economic relations. The volume of international trade has a value estimate. The nominal value of international trade is usually expressed in US dollars at current prices and is therefore highly dependent on the dynamics of the dollar exchange rate against other currencies. The real volume of international trade is the nominal volume converted into constant prices using a chosen deflator. In general, the nominal value of world trade has a general upward trend (see Table 8). In value terms, the volume of world trade in 2000 was $12 trillion, almost three times lower than the value of world GDP ($33 trillion).

Structure of international trade

The structure of international trade is usually considered in terms of its geographical distribution (geographical structure) and commodity content (commodity structure).

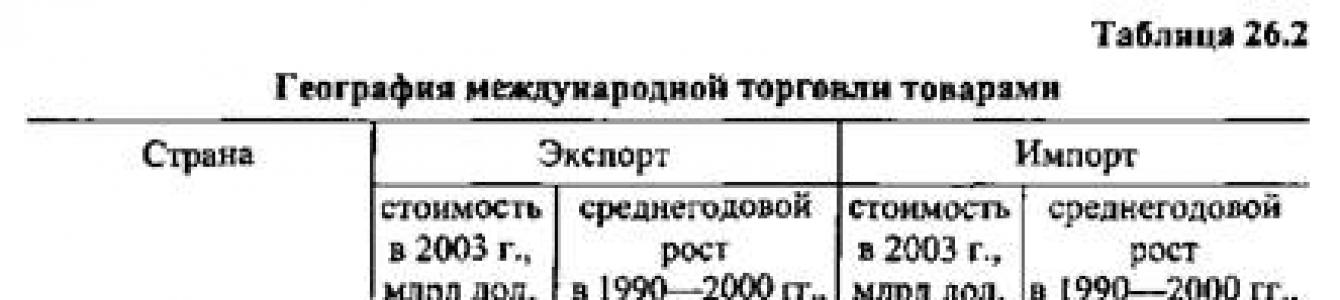

The geographical structure of international trade is the distribution of trade flows between individual countries and their groups, identified either on a territorial or organizational basis (Table 7).

Table 3 Geographic structure of international trade (increase in international trade by region in 1995-1999, in %)

The main volume of international trade falls on developed countries, although their share decreased slightly in the first half of the 1990s due to an increase in the share of developing countries and countries with economies in transition (mainly due to the rapidly developing new industrial countries of Southeast Asia - Korea, Singapore , Hong Kong - and some Latin American countries) (Table 8).

Data on the commodity structure of international trade in the world as a whole is very incomplete. We note the most significant trends.

Since the beginning of the 20th century, two "floors" have emerged in the structure of the world commodity market - the market for basic goods (fuel, minerals, agricultural products, timber) and the market for finished products. The first type of goods was produced by developing and former socialist countries specializing in the export of resource- and labor-intensive goods. Of the 132 developing countries, 15 specialize in the export of oil, 43 in the export of mineral and agricultural raw materials. The goods of the second "floor" are the prerogative of the industrialized countries.

In the second half of the twentieth century, in the context of the rapid development of electronics, automation, telecommunications, and biotechnology, the "second floor" was divided into three levels:

1st level - the market of low-tech products (ferrous metallurgy products, textiles, footwear, other light industry products);

2nd level - the market of medium-tech products (machine tools, vehicles, rubber and plastic products, products of basic chemistry and wood processing);

3rd level - the market of high-tech products (aerospace engineering, information technology, electronics, pharmaceuticals, precision measuring instruments, electrical equipment).

|

Place in rate. (1997) |

Export, 1997 |

Import, 1997 |

Place in rate. (2001) |

Export, 2001 |

Import, 2001 |

||

|

Germany Great Britain Netherlands South Korea Singapore Malaysia Switzerland Russia Australia Brazil Indonesia |

In the last decade, the 3rd level of the world market for finished products has been expanding rapidly: its share in total world exports has increased from 9.9% in the early 80s to 18.4% in the early 90s.

The "upper tier of the 2nd level" is the sphere of the fiercest competition between industrialized countries. In the market for medium- and low-tech finished products, NIS are fighting. The number of participants in this struggle is constantly increasing at the expense of the developing and former socialist countries.

According to UN experts, at the end of the 20th century, 75% of world exports were manufactured products, while ½ of this indicator falls on technically complex goods and machines. Food products, including drinks and tobacco, account for 8% of world exports. Mineral raw materials and fuel - 12%. AT recent times there is an increase in the share in world exports of textile products and finished products of the manufacturing industry up to 77%. In addition, the share of services, means of communication and information technologies.

5. Pricing in world trade. Foreign trade multiplier

A characteristic feature of world trade is the presence of a special system of prices - world prices. They are based on international production costs, which gravitate to the average world costs of economic resources for the creation of this type of goods. International production costs are formed under the predominant influence of countries that are the main suppliers of these types of goods to the world market. In addition, the ratio of supply and demand for this type of product in the world market has a significant impact on the level of world prices.

International trade is characterized by a plurality of prices, that is, the existence of different prices for the same product. World prices vary depending on the time of year, place, conditions for the sale of goods, features of the contract. In practice, world prices are taken to be the prices of large, systematic and stable export or import transactions concluded in certain centers of world trade by well-known firms - exporters or importers of the relevant types of goods. For many raw materials (cereals, cotton, rubber, etc.), world prices are set in the process of trading on the world's largest commodity exchanges.

The international value is usually less than the national value of the corresponding goods, since the most competitive goods, that is, those produced at the lowest cost, are usually supplied to the world market. Other factors also influence world prices: the ratio of supply and demand, product quality, the state of the monetary sphere. However, long-term trends in the formation of world prices manifest themselves as universal action the law of value in the world market. As an illustration of world pricing, we present Table. 9.

Table 4 Average monthly world prices in June of the corresponding year (according to the data of the International Petroleum Exchange (London) and London Metal Exchange)

|

Oil (Brent), USD/t |

|||||||||

|

Natural gas, USD/thousand m3 |

|||||||||

|

Gasoline, USD/t |

|||||||||

|

Copper, USD/t |

|||||||||

|

Aluminum, USD/t |

|||||||||

|

Nickel, USD/t |

To quantify the impact of foreign trade on the growth of the national income and GNP of the country, a foreign trade multiplier model has been developed and is used in practice.

Recall that the multiplication principle characterizes the impact exerted by investment, and ultimately by any expenditure, on the growth of employment and the increment in output (income), that is

MULT == 1/1-s,

where ДY - increase in income, and ДI - increase in investments; c is the marginal propensity to consume.

The foreign trade multiplier model can be calculated using a similar scheme. At the same time, we will assume that imports and exports can have an independent impact on the development of the national economy of a country participating in foreign economic activity. The impact of imports in this case can be equated with the impact of consumption, and the impact of exports - with the investment impact. Accordingly, the marginal propensity to consume in this case takes the form of the marginal propensity to import: c = m = M/Y, and the marginal propensity to save - the form of the marginal propensity to export: s = x = X/Y. An autonomous change in exports will have the following impact on income growth:

This is the foreign trade multiplier.

In real life, exports and imports are interconnected. The country's import is also an export for the counterparty state. Such interdependence significantly complicates the multiplier model, which, in order to reflect real foreign trade relations, must take into account the interaction of at least two countries. Consider the multiplier model on the example of the development of relations between two countries - country 1 and country 2, between which there are foreign trade relations. At the same time, the export of country 1 is completely sent to country 2 and equals its import, and vice versa. If we also assume that the change in investment occurs only in country 1, then the final formula of the foreign trade multiplier will take the form:

This formula substantiates the dependence of the change in the income of country 1, due to the change in investment, on the marginal propensity to consume and to import not only country 1, but also country 2. An increase in investment in the investor country (country 1) causes an increase in income in it as a result of the multiplier effect, at the same time stimulates imports, which act as exports for the counterparty country (country 2). In turn, the export of country 2 stimulates the growth of its income.

Brief conclusions

International trade is one of the most developed and traditional forms of international economic relations. In the field of international trade, there is intense competition, since the economic interests of almost all the main subjects of the world economy collide here. International trade consists of two opposite flows - exports and imports. The nominal volume of international trade as a whole has a general upward trend. Since prices in international trade are rising, the value of trade is growing faster than its physical volume.

Simultaneously with the growth of the scale of international trade, its structure is also changing - geographical shifts (changes in the ratios between countries and groups of countries) and shifts in the commodity structure.

Classical theories of international trade laid the foundations for the analysis of world economic relations. The conclusions contained in these theories have become a kind of starting axioms for the further development of economic thought.

The process of development of world trade is subject to the action of the multiplier effect.

Hosted on Allbest.ru

Similar Documents

The essence and concept of international trade. Classical theory of international trade. Sectoral structure of world trade. Legal support of world trade. Aspects of international trade.

abstract, added 05/05/2005

The impact of international trade on the world economy and international economic relations. Types of world trade, its mechanisms, indicators of the state and development. Features of international trade in services and goods, the world's leading exporters.

abstract, added 12/11/2010

The concept of the world market and foreign trade. Features of foreign trade policy in modern conditions. World regulation of foreign trade. Indicators of world trade in goods. Prospects for the development of foreign trade relations of the Republic of Belarus.

term paper, added 02/20/2013

Basic theories of international trade. The essence and role of foreign trade in the country's economy. Foreign trade policy of Russia. The possibility of developing the country's foreign trade policy in the context of the globalization of world trade. Trade policy instruments.

term paper, added 04/16/2015

Study of the activities of the World Trade Organization. Main tasks of the global organization on tariffs and trade. Analysis of the features of regulation of customs and tariff issues of world trade. Overview of statistics on world trade in goods and services.

report, added 04/25/2016

International trade is a system of international commodity-money relations, consisting of the foreign trade of all countries of the world. Advantages of participation in world trade, the dynamics of its development. Classical theories of international trade, their essence.

presentation, added 12/16/2012

Basic theories of international trade, main principles, specific features. Varieties of modern world trade. The levers of state regulation of international trade, features and trends of its development in the context of the economic crisis.

term paper, added 03/04/2010

Essence and basic concepts of foreign trade, features of its regulation. Types of international trade policy. Criteria for determining the forms of international trade. Methods for the implementation of trade exchange. Foreign trade of countries with economies in transition.

term paper, added 02/16/2012

The main trends in the development of world trade. The system of regulation of international trade. Framework standards as one of the conditions for the security and facilitation of world trade. The main features of the current stage of the functioning of the world economy.

abstract, added 11/06/2013

The main trends in the dynamics and structure of international trade in goods at the present stage. Factors of growth of world trade. Analysis of the specifics of the development of world commodity policy over the past five years. Ways to improve the efficiency of world trade.

Foreign trade policy. Pricing in international trade. Foreign trade balance.

The traditional and most developed form of international economic relations is foreign trade. According to some estimates, trade accounts for about 80% of the total volume of international economic relations.

International trade is a form of communication between producers of different countries, arising on the basis of MRI, and expresses their mutual dependence. Modern international economic relations, characterized by the active development of world trade, bring a lot of new and specific features to the process of development of national economies.

Structural shifts taking place in the economies of various countries under the influence of scientific and technological revolution, specialization and cooperation of industrial production enhance the interaction of national economies. This contributes to the intensification of international trade. Up to a quarter of the world's production enters the international trading system every year. International trade, which mediates the movement of all intercountry commodity flows, is growing faster than production. According to WTO research, for every 10% increase in world production, there is a 16% increase in world trade. This creates more favorable conditions for its development. Foreign trade has become a powerful factor in economic growth. At the same time, the dependence of countries on international trade increased significantly.

The term "foreign trade" refers to the trade of a country with other countries, consisting of paid import (import) and paid export (export) of goods.

Diverse foreign trade activities are subdivided according to commodity specialization into trade in finished products, machinery and equipment, raw materials, services, and technologies. In recent decades, trading in financial instruments (derivatives), derivatives of financial instruments circulating on the cash market, such as bonds or shares, has been booming.

International trade appears as the total volume of trade of all countries of the world. However, the term "international trade" is used in a narrower sense. It denotes, for example, the total volume of foreign trade of industrialized countries, the total volume of foreign trade of developing countries, the total volume of foreign trade of countries of a continent, region, for example, countries of Eastern Europe, etc.

International trade is characterized by three main indicators: turnover (total volume), commodity structure and geographical structure.

Foreign trade turnover includes the sum of the value of exports and imports of a country participating in international trade. There are cost and physical volumes of foreign trade.

The value volume is calculated for a certain period of time in current (changing) prices of the corresponding years using current exchange rates.

The physical volume of foreign trade is calculated at constant prices. On its basis, it is possible to make the necessary comparisons and determine the real dynamics of foreign trade. The volume of international trade is calculated by summing the export volumes of all countries.

Since the second half of the XX century. world trade is growing rapidly. Between 1950 and 1994, world trade grew 14 times. According to Western experts, the period between 1950 and 1970 can be characterized as a "golden age" in the development of international trade. It was during this period that an annual 7% growth in world exports was achieved. it decreased slightly (up to 5%). At the end of the 80s. world exports showed a noticeable recovery (up to 8.5% in 1988). After a temporary decline in the early 1990s, in the second half of the 1990s, international trade again demonstrates high and stable rates (7-9%).

A number of factors influenced the rather stable, sustainable growth of international trade:

stabilization of interstate relations in the conditions of peace,

development of MRT and internationalization of production and capital,

Scientific and technological revolution, which contributes to the renewal of fixed capital, the creation of new sectors of the economy, accelerating the reconstruction of old ones,

active activity of international corporations in the world market,

the emergence of a new commercial reality - a global market for standardized goods,

· regulation of international trade through international trade agreements adopted under the GATT / WTO;

the activities of international financial and economic organizations, such as the IMF, which maintains the relative stability of the main world currencies, trade and payment balances of many countries,

stabilizing activity of the World Bank in relation to the world economy,

· liberalization of international trade, the transition of many countries to a regime that includes the abolition of quantitative restrictions on imports and a significant reduction in customs duties - the formation of "free economic zones";

development of trade and economic integration processes, elimination of regional barriers, formation of "common markets", free trade zones,

· Gaining political independence by the former colonial countries, separating from among them countries with an economic model oriented to the foreign market.

Fast growth world trade in the mid-1990s. mainly due to a sharp increase in imports from the United States, Italy, Canada, Spain, the expansion of trade within the OECD group of countries, as well as an improvement in the economic situation in developed countries (except Japan), Far East and in Latin America.

If the elimination of trade barriers continues successfully, the capacity of the goods market will grow by an average of 6% annually over the next ten years. This will be the highest rate since the 1960s. Trade in the sphere of services will increase even more rapidly, which is greatly facilitated by the success of computer science and communications.

The structure of international trade is usually considered in terms of its geographical distribution (geographical structure) and commodity content (commodity structure).

The geographical structure of international trade is the distribution of trade flows between individual countries and their groups, distinguished either on a territorial or organizational basis.

The territorial geographic structure of trade usually summarizes data on the international trade of countries belonging to one part of the world (Africa, Asia, Europe) or to an enlarged group of countries (industrial countries, developing countries) (Table 4.1).

Table 4.1

Geographical structure of international trade (exports) (in %)

The organizational geographical structure shows the distribution of international trade either between countries belonging to individual integration and other trade and political associations (European Union countries, CIS countries, ASEAN countries), or between countries allocated to a certain group in accordance with some analytical criterion ( oil exporting countries, net debtor countries).

The main volume of international trade falls on developed countries, although their share declined somewhat in the first half of the 1990s due to the growth in the share of developing countries and countries with economies in transition. The main growth in the share of developing countries occurred due to the rapidly developing new industrial countries of Southeast Asia (Korea, Singapore, Hong Kong) and some Latin American countries. The world's largest exporters (in billion dollars) are the USA (512), Germany (420), Japan (395), France (328). Among developing countries, the largest exporters are Hong Kong (151), Singapore (96), Malaysia (58), Thailand (42). Among the countries with economies in transition, the largest exporters are China (120), Russia - (63), Poland (17), Czech Republic (13), Hungary (11). In most cases, the largest exporters are also the largest importers in the world market.

Data on the commodity structure of international trade in the world as a whole is very incomplete. Usually, either the Harmonized Commodity Description and Coding System (HSCT) or the UN Standard International Classification (SITC) is used to classify individual goods in international trade. The most significant trend is the growth in the share of trade in manufactured products, which accounted for about ¾ of the value of world exports by the mid-1990s, and the reduction in the share of raw materials and foodstuffs, which accounted for about ¼ (Table 4.2).

Table 4.2